How to use incentives from the Inflation Reduction Act to reduce your home’s carbon footprint

By Kristina Murphy

The incentives of the Inflation Reduction Act have started to become available, which makes it the perfect time to start planning to electrify your home.

Federal tax credits and rebates will make it far less costly to insulate your home and electrify your appliances. An insulated, electrified home will save you money over time — and will lower your greenhouse gas emissions.

As the largest climate bill in history, the IRA allocated $369 billion for energy security and climate solutions. As former Vice President Al Gore recently said in his presentation at the April Climate Reality Leadership Corps training, the amount will likely end up even larger than that because there is no cap on the amount of building electrification tax credits available to the public between now and 2032.

“The IRA, when combined with existing policy, has the potential to lower U.S. emissions to 40% below 2005 levels by 2030,” Gore said in his presentation.

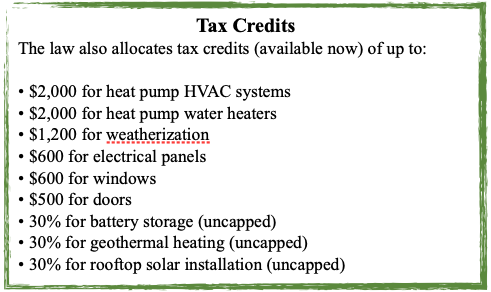

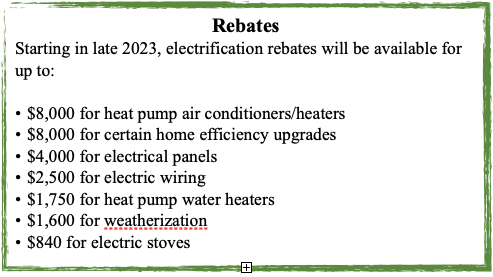

The law provides federal tax credits (available now) for people with sufficient tax liability and rebates to low and moderate income households, as well as renters, for home electrification and energy efficiency improvements. In addition, state and local incentives can be combined with federal incentives to maximize cost savings. Rebates will be available by early 2024 through state energy offices.

One thing to keep in mind is that if you do not insulate and air seal your home first, you may purchase a heating/cooling system that is oversized for your home. Before investing in a new cold climate air source heat pump to replace your heating and cooling systems, I recommend you first obtain a home energy audit, then insulate and air seal your home. Air sealing may entail caulking cracks, filling gaps with foam, or replacing windows and doors. A cold climate air source heat pump replaces both your gas furnace and air conditioner. Heat pumps operate by extracting and moving heat either inside or outside, depending on the season.

To install your new appliances, such as an electric clothes dryer, electric or induction stove, or electric water heater, you may need to install a 240-Volt outlet. Electrical upgrades are eligible for credits and rebates.

The total annual credit is capped at $3,200 per household per year ($2,000 for heat pumps/heat pump water heaters; $1,200 for everything else). These credits reset each year. One way to manage these limits is to spread out the work over multiple years, which may match your own budgeting requirements.

To help you figure out which rebates and/or tax credits you are eligible for, check out Rewiring America’s IRA Calculator, which allows you to enter your household size, location, and annual income to determine your incentives. Their fact sheets are also quite useful.

Rewiring America’s “Go Electric!” and “Electrify Everything in Your Home” guides provide details on how to electrify your home.

When determining which improvements to complete first in your home, there is no one way to go about the process. Sometimes an appliance breaks sooner than anticipated; whenever you need to replace an appliance, it is an opportunity to purchase an efficient electric one.

If you are not aware of your home’s electrical capacity, it is prudent to contact an electrician to find out well before any appliance breaks. Typically, 200 Amps service is needed; however, it may be possible to continue to use 100 Amps service with a smart controller to manage electrical loads. You may need to install new wiring, 240-Volt outlets, and expand your breaker box to support new appliances.

Rebate Eligibility

Eligibility for rebates is determined by the Area Median Income for your metropolitan region. Housing and Urban Development (HUD) publishes these tables.

For a family of four in the Chicago region, low income is considered 80% or less of the area median income — $83,350 or less annually. For families of four, moderate income is considered 81% to 150% of the area median income — $83,351 to $156,300 annually. Households that earn more than the moderate income will not be eligible for rebates. Low income households will be eligible for 100% of the rebate amount, while moderate income households will be eligible for 50% of the rebate. Rebates will be available by late 2023 or early 2024 from the state’s energy office. Federal tax credits are available to everyone if they have at least that amount of tax liability. Consult your tax advisor for additional information.

Renters

Renters have multiple ways to take advantage of incentives. They can purchase portable appliances: clothes dryers, ranges, and window unit air conditioners; and educate and request their landlords replace appliances with electric alternatives.

To help promote these incentives to transform our energy economy, we as Climate Reality Leaders can give presentations, public comments at local government meetings, and work with our municipalities to get the word out about these incentives.

Links

- The White House Clean Energy Guidebook

- For more tips on where to go to electrify your home check out Blocpower.io. This site offers multiple resources for home and building owners, as well as municipal and utility leaders.

- Rewiring America also has a program to help educate local government leaders about electrification. Learn more at localgovleadersforelectrification.org

- For more about tax credits for homeowners go to EnergyStar

Kristina Murphy is co-founder of Accelerate Climate Solutions and serves as Vice President of the Board. She owns Confluence Climate Consulting LLC. Kris, an atmospherice scientist with nearly 25 years of experience in water engineering, is a Certified Climate Change Professional (CC-P) and a Certified Floodplain Manager (CFM). She chairs the Sustainable Aurora Advisory Board; participates in the Naperville Environment and Sustainability Task Force leadership and Building and Development committees; is an at-large board member of Climate Reality Chicago Metro and co-chairs their Suburban Climate Action Planning committee. When Kris is not giving presentations on ways to reduce our emissions and create resilient infrastructure, she enjoys baking and organic gardening with her young son.